A country’s growth depends on various factors and one of the most important is its economic growth. All the activities that involve transactions of money in place of goods and services add up to the company’s growth as well as the country’s growth. Keeping this in mind, it is very clear that the country will progress much better if it is free from corruption. Therefore, to keep the country free from black money it has become very important that companies and the government follow up with measures to abolish corruption and introduce measures to completely keep a check on illegal transfer of money.

Due to this, government organizations and companies are taking continuous actions to completely free the country corruption-free. Now, to keep a check on the secure transfer of money, the government and firms are hiring AML/KYC Compliance Officers. In order to ensure that all the transactions are being processed with all fair means, there is an urgent need for officers like the AML/KYC Compliance Officers to regulate the same.

In this blog, we will discuss various career opportunities that are present in this field. Moreover, we’ll also discuss the process of becoming an AML/KYC Compliance Officer along with all the qualifications and other important details that are required in order to have a successful career in this field.

Let’s discuss what AML and KYC are!

What is AML and KYC?

AMC and KYC stand for Anti-Money Laundering and Know your Customer respectively. These two terms have different meanings and hence are interrelated to each other. We can say that AML refers to a more comprehensive set of provisions developed to control financial crimes like money laundering and terrorism financing. Whereas, KYC refers to the customer identification and screening process that must be taken to verify a customer and ensure you understand their risk to your business.

The major objective of AML and KYC compliance is to prevent banks from being exploited, by criminal segments for money laundering movements. Moreover, it also allows banks to comprehend their customers and their financial transactions to benefit them better and manage their risks more efficiently. These processes have helped banks, companies, government, etc, to reduce the illegal seizure of money and allowed them to put their money through a series of commercial transactions in order to “clean” the money.

Who is an AML/KYC Officer?

These are the professionals who are knowledgeable and are familiar with the workings of the anti-money laundering systems and their main objective is to ensure that everything that happens within the organization is in compliance. These days many reputed and big companies are hiring these professionals so that they can educate the customers regarding the security of the company and make them believe in the services offered by the firm as well. Moreover, with the increasing demand for AML/KYC compliance officers, it has become one of the booming careers of all time.

Roles and Responsibilities of an AML/KYC Compliance Officer

With work comes great roles and responsibilities. Some of the major roles and responsibilities of AML/KYC Compliance Officers are listed below:

- Implementing various inspections and audits from third-party organizations.

- Overseeing and implementing an ongoing AML training program.

- Determining the risk level of customers.

- Implementing the company’s anti-money laundering compliance policy.

- Following all AML regulations and laws.

- Taking protective measures against financial crimes to the company.

- Detecting suspicious transactions and then report for it.

Skills Required to become an AML/KYC Compliance Officer

It is important to understand all the skillset required to become a knowledgable AML/KYC Compliance Officer. Some of the skills required are listed below:

- Knowledge of the AML, KYC and other compliance software for transaction, reporting, and monitoring purposes.

- Risk management.

- Hands on maintaing records, accounts, and making presentations.

- Knowledge of MS Office applications like Word, Powerpoint, and excel.

- Communication and interpersonal skills.

- Analytical skills.

- Problem-solving and decision-making skills.

Career Paths to Follow

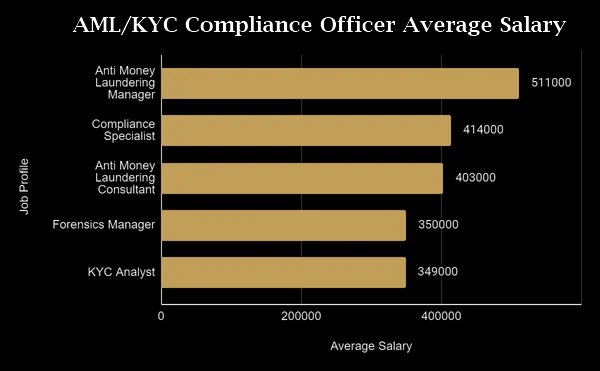

1. KYC Analyst

A KYC Analyst is the one who review all the documentations for the new accounts. They basically evaluate high-risk accounts and analyze all the processes and policies. These professionals holds an important position in the firm. If you’re a graduate and starting as a KYC Analyst position then you can count on exciting career and growth opportunities within the financial services industry

Average Salary: INR 3.7 Lakhs per annum

2. Forensics Manager

A Forensic Manager is the one who manages laboratory units within the Forensics and Evidence Division. They are responsible for supervising first line Forensic Supervisors, Criminalist Supervisors and/or individual contributors. Moreover, they also screen, treat, and manage clients and works to investigate and recommend supportive services to them.

Average Salary: INR 3.5 Lakhs per annum

3. Anti Money Laundering Consultant

An AML Consultant is the one who controls money laundering by constructing and implementing anti-money laundering guidelines, issuing notices to bank employees about questionable activity, considering questionable bank transactions, and determining movements in questionable bank conventions. These professionals are in great demand these days. If you’re highly skilled and knowledgable then this is one of the most sought after career.

Average Salary: INR 4.03 Lakhs per annum

4. Compliance Specialist

Entering a compliance job is a rewarding, exciting, satisfying and varied experience. These professionals ensure that the organizations comply with all the relevant laws, regulations, and policies. Moreover, they are also responsible for monitoring and documenting compliance activities, counseling leadership and management on compliance topics, and liaising with government agencies. If you’re looking up for a career in compliance then this is the best career path for you.

Average Salary: INR 4.2 Lakhs per annum

5. Anti Money Laundering Manager

An AML Manager is the one who works to make the investigation process of suspicious activities more simpler and more effective. They combine technologically cutting-edge features and a user-friendly, data-rich interface with powerful prevention and detailed tracking tools. Since, these professionals work on risk management and reporting suspicious activities therefore, they’re in huge demand by various MNCs all over the country.

Average Salary: INR 5.1 Lakhs per annum

Salary trend of a AML/KYC Compliance Officer

The average salary of a compliance officer in India is INR 3.8 lakhs per annum, only if you have completed all the aforementioned courses. You might still get the job without completing the certifications but that will cut your salary a bit. So it is highly recommended to take up all the certifications as soon as possible. Moreover, the salary of a compliance officer increases with an increase in their experience. Therefore, an experienced officer will take a large amount rather than a beginner. So you need to be patient while working and attain as much job experience as you can.

What do the companies expect from an AML/KYC Compliance Officer?

It is expected that you have a basic educational requirement to be eligible to become an AML/KYC Compliance Officer is a graduate degree in any discipline. However, having a degree related to the same field like finance, accounts, etc, will definitely prove to be helpful and are given preference as well. Let’s discuss some of the expectations a company will have from you as an AML/KYC Compliance Officer.

- To deal with all the paperwork and work under strict office conditions with minimal or no weekend work involved.

- You may also be expected to work from home since the job is mostly a desk-based.

- To work according to the client’s time zone.

- Working on oddly timings due to customers from outside India.

- You are expected to be highly professional, possess high integrity, and self-respect.

Reading all the requirements of a company from an AML/KYC Compliance Officer. If you have the zeal to do all the hard work and are confident enough to deal with all the work ethics then you should definitely look forward to becoming a compliance officer.

Preparation Guide to become an AML/KYC Compliance Officer

If you’ve decided your career path to become an AML/KYC Compliance Officer then the next step that you should look forward to is from where to start? The internet is filled with numerous resources and online courses but selecting the best and the right one that satisfies all your requirements is a difficult task. Guess what? We along with our experts have created the best certification course for you that will give you exactly what you desire for. The Vskills Cetified AML/KYC Compliance Officer is the best certification course for you. Moreover, we’ll discuss about various steps that will help you in becoming an AML/KYC Compliance Officer.

Refer to Vskills online resources

Taking up the Vskills Certified AML/KYC Compliance Officer exam will provide you access to e-learning material along with hard copies for preparation for the exam. Moreover, you’ll get lifetime access to the online material and you can look up to them any time. Furthermore, taking up online resources will save your time as well as money and will keep you updated with any changes related to the topic.

Books for Reference

Learning from a reference book will provide you with benefit to understand and learn things more accurately and efficiently. There are numerous books for AML/KYC Compliance Officer exam but the best one that we will recommend our users is “AML Auditing – Understanding KYC Compliance (Volume 1) 1st Edition by Bob Walsh“.

Take Practice Tests

Taking up practice tests is one of the best way to test your learning and knowledge so far. Practice tests are important for better preparation and better results. Therefore, we are here to provide you with the latest practice tests that will help you calculate your performance before taking up the final exam. So, make sure to find the best practice sources.

AML KYC Best Interview Questions

You should also have a look at the best AML/KYC best interview questions in the banking as well as the corporate sector. Moreover, these questions are highly updated and will help you boost your interview skills and boost your chances to achieve the best career opportunities for yourself in the future.