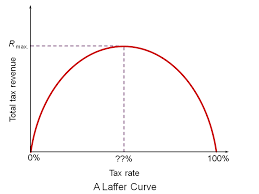

According to Laffer Curve, as taxes increase from low levels the tax revenue collected by the government will also increase. After tax rate increases and reaches a certain level people will stop working hard as they used to and hence the revenue will decrease. Laffer explained it to the Ford administration in 1974. In the above figure, beyond the point t* people will start working less because they will think of the increased tax rate as a penalty on their activities and hence, the tax revenue collected by the government will start to decline. t* represents the point at which maximum revenue is generated. Laffer curve suggests that lower tax rates have a positive impact on people as it provides incentives to increase their activities. t* need not be on 50% tax rate. It can be on any tax rate which is greater than 0% and less than 100%.

Basically tax rates have two effects on revenue. They are “arithmetic effect” and “economic effect”. The arithmetic effect assumes that tax revenue raised is equal to the tax rate multiplied by the revenue available for taxation (also known as tax base). If rates are lowered, the tax revenues will be lowered by the amount of the decrease in the rate, and vice versa for increasing tax rates. For example, suppose at a tax rate of 3%, the revenue collected is Rs. 3 crore, then if the tax rate increases to 8%, then the revenue collected will also increase to Rs. 8 crore.Economic effect assumes that the tax rates will have an impact on the tax base itself. Therefore, they try to find a tax rate between 0% and 100% that will maximize the revenues. However, the Laffer Curve does not say that “all tax cuts pay for themselves” as many people claim. Tax rate cuts will always lead to more growth, employment, and income for citizens.

Click here for government certification in Accounting, Banking & Finance

5 Comments. Leave new

Laffer curve has a great economic significance. Your article highlights much about it. Good one B-)

A new topic.. nice..

Nice article

Laffer Curve also expresses how hugh taxes demotivate the people to work hard.

New topic for me as the language was simple , got it easily ;D in one go

GOod work 😀