The price to book value ratio is one of the most important ratios used to value a company. It helps the investors determine if the company the person wants to invest in is giving good worth of the money he has to pay for the shares. The shares of the company usually are exchange-traded in stock exchanges like the NSE or BSE or may be available as

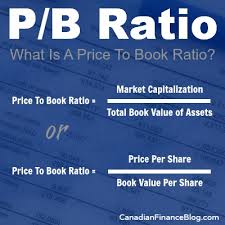

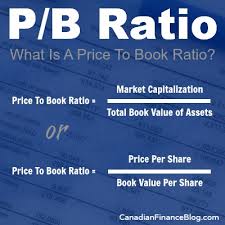

P/B ratio is determined using the following formula :

P/B Ratio=Share Price/Book value per share of the company

Share Price: The share price of the company can be ascertained by looking at the latest price at which the share is being traded at in the stock exchange, by finding out the price at which the share can be bought this element is determined.

Book Value Of the Company: It is the total amount of the company’s assets that shareholders would theoretically receive if a company were to be liquidated. The book value of a share can be ascertained by adjusting all tangible assets of the company against the liabilities and depreciation.after getting the book value of the company and dividing it with the total number of shares the company has book value per share will be found.

For value investors, P/B remains a tried and tested method for finding low priced stocks that the market has neglected. If the ratio is less than 1 then it is considered that the share is undervalued and buying the share at that price would be a great bargain. It is also warning that something may be fundamentally wrong with it. If the value of the ratio is more than one then the share price is considered a bit overprice. However, the interpretation of the ratio depends upon the condition of the company. It is up to the investor how he interprets the company to be from the P/B ratio. The ones successful at correctly interpreting if a low P/B ratio means an undervalued stock or it is a worthless stock can successfully use it to discover stocks trading at a lower value, held them over a long-term and get very decent profits in their books. This ratio has earned quite a lot of fame and name among value investors.

Click here for government certification in Accounting, Banking & Finance

Stay Ahead with the Power of Upskilling - Invest in Yourself!

Stay Ahead with the Power of Upskilling - Invest in Yourself!

9 Comments. Leave new

informative article

Knowledgeable article

Definitely, this ratio is very useful. Thanks for posting such an informative article.

Very useful and Good effort!

Well written.

good one

well done

Well Structured Article 😀

Good work 😀

great work…