In trading and investing, there are many different types of strategies that market participants employ. However, there are some of the larger and more important types of strategies. Technical analysis is one of them.

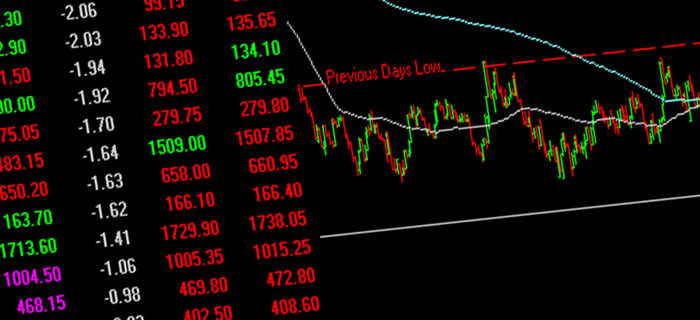

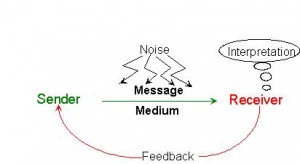

Unlike fundamental analysis, technical analysts or technicians do not care about the value of the company or the company as a whole. All they really care about is the price movement in the market. they employ lots of fancy tools to study the supply and demand in the market in order to attempt to determine the direction or trend in the future. Another way of describing them is that they try to understand the emotions of the market by studying the market itself as opposed to its components like fundamental analysts do. Technicians evaluate stocks by analysing the statistics generated by market activity such as prices and volume. They do not attempt to measure the intrinsic value but instead use charts and tools to figure out the pattern. technical analysis is based on three assumptions- (i) The market discounts everything, (ii) Price moves in trends and (iii) History tends to repeat itself. Technical analysts only consider price movements and ignore the fundamental factors of a company. The reason for this is that the technicians assume that at any given time, the stock price reflects everything that has or could affect the company including the fundamental factors. They believe that the company’s fundamentals as well as the market psychology are priced into the stock. Therefore, there is no need to analyse the company itself.

Technicians believe in the concept called the efficient market hypothesis, which states that stock market efficiency reflects and incorporates all relevant information in the stock price. So, basically goes against what fundamental analysts believe in. In technical analysis, stock price movements are said to occur in trends. This means that when a trend has been located, the future price will move in the same direction as the trend. The last important idea of technical analysis is that “History repeats itself”. The repetitive patterns are due to market psychology. Market participants tend to provide a consistent reaction to similar market activities.

Usually, fundamental analysis is used when you are looking at the long-term analysis of a stock, while technical analysis is used for short term trading. Even though fundamental and technical analysis might seem contrary to each other, they can still both co-exist. That can actually give the trader or investor a higher chance of success as he/she can analyse for both the long as well as the short term of the stock.

Click here for government certification in Accounting, Banking & Finance

9 Comments. Leave new

good one!

good one ……well explained….

Good effort..!

wonderfully described!!!

good work.

Excellently described.. Great work!

well done

quite technical!

Informative