Financial Inclusion is the delivery of financial services at affordable cost especially to low income segments of the society.

The Financial Inclusion is important in India in the following way

1. To improve the habit of saving money-By providing banking services and various financial products.

2. Providing formal credit avenues-By providing credit facilities to low income segments.

3. Plugging gaps in public subsidies and welfare programs- By availing the direct fund transfer schemes.

Reserve Bank Of India and Government of India have taken the steps for the financial inclusion.

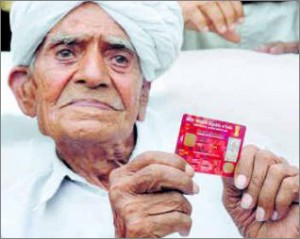

1. Pradhan Mantari Jhan Dhan Yojana Scheme

2. Electronically fund transfer Scheme

3. Opening the account at zero balance.

4. Banking Service reaches homes through business correspondents.

This will help the low income segment to save money and also to get credit and as money enters into the market it helps in the economic growth of the country.

Click here for government certification in Accounting, Banking & Finance

7 Comments. Leave new

Good work!

Is financial inclusion and subsidy the same thing?

Good work but need more information..!

Financial inclusion is basically covering the entire nation in its economy. Getting bank accounts operated by each and every individual would bring them into the economic cycle of the nation. I just felt that the blog could have been made more informative and clear. Nonetheless, Keep trying 🙂

Financial Inclusion in a country like India is possible only due to Jan Dhan Yojna.

Nice..

good work 🙂