Second Tenet

We shall now discuss the three phases to every primary trend. Primary trend is discussed in particular as it is the most vital and crucial trends in the market.

Primary Upward Trend in the Bull Market

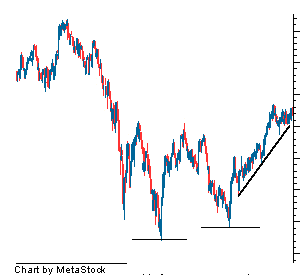

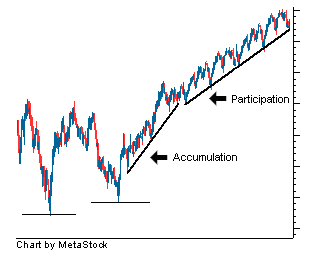

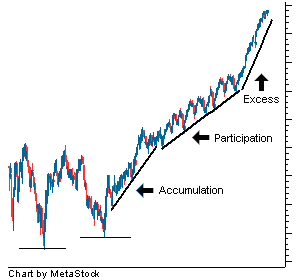

- Accumulation Phase: Accumulation phase is the start of the upward trend and comes at the end of the downtrend. It is the first stage of a bull market such that the informed investors starts entering the market. The accumulation phase can be very difficult to spot as it comes at the end of a downward move, which can even be a secondary move in a primary downward trend, instead of being a start of a new uptrend. From a technical point of view, the start of the accumulation phase will be marked by a period of price consolidation in the market which occurs when the downtrend starts to flatten out, as selling pressure starts to dissipate.

- Public Participation Phase: The investors enters the accumulation phase with the assumption that the worst is over and recovery is expected. Once this happens the primary trend moves into the public participation phase. The negative sentiments disperses and economic growth with strong economic data is anticipated. This leads to increased investor penetration leading to higher prices. In this phase most technical and trend traders starts taking long position once the upward primary trend confirms.

- Excess Phase: This is a very lucrative phase for all the investors due to the improved business condition, the market starts making a strong move higher. In this phase the smart money starts to scale back its position. This is also usually the time when the last of the buyers start to enter the market – after large gains have been achieved. There should be a lot of attention placed of signs of weaknesses in the trend, for example if the upward trend starts to show weaknesses then it can mark the start of a primary downward trend.

Primary Downward Trend in the Bear Market

- Distribution Phase: Distribution phase is the first phase in the bear market in which informed buyers sell their positions i.e., they are now selling into an overbought market instead of buying in an oversold market.There is continued buying by the last of the investors in the market with a hope of a big move in the near future. The distribution phase can be difficult to spot in its early stages because it may be disguised as a secondary downward trend within the primary upward trend. Technically the distribution phase is represented as the phase where the price movement starts to flatten due to increased selling pressure.

- Public Participation Phase: This phase encounters business condition getting worst and thereby developing negative sentiment. In this phase most technical traders and trend followers start dumping their position as the downtrend confirms itself. The selling increases and the buying dries up.

- Panic Phase: This is last phase of the primary downtrend market filled with extreme market panic leading to very large sell-offs in a short span of time. The market is wrecked with negative sentiments due to panic causing the investors to surrender their stakes. Generally, these investors are the one’s who have just entered the market.

Apply for Technical Analysis Certification Now!!

http://www.vskills.in/certification/Certified-Technical-Analyst