Portfolio Management Process

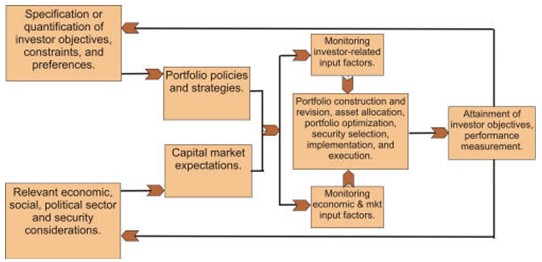

Portfolio management is a systematic process of selecting, monitoring, and adjusting investments in a portfolio to meet the investor’s financial objectives. The portfolio management process involves creating an investment strategy that considers the investor’s risk tolerance, financial goals, and investment timeline. The process also includes monitoring the portfolio’s performance and making adjustments when necessary to ensure that it continues to align with the investor’s objectives.

The first step in the portfolio management process is to define the investor’s financial goals and risk tolerance. This involves considering the investor’s investment timeline, income, and other financial obligations. Based on this information, the portfolio manager can develop an investment strategy that balances risk and return to meet the investor’s financial objectives.

Once the investment strategy has been established, the portfolio manager selects investments that fit within the strategy. This involves researching and analyzing potential investments to determine their potential returns and risks. The portfolio manager then constructs the portfolio by allocating investments across different asset classes and diversifying the portfolio to reduce risk. The portfolio is then monitored regularly to ensure that it continues to align with the investor’s financial objectives, and adjustments are made when necessary to maintain the portfolio’s performance.

The focus of portfolio management is to match the characteristics of the assets with the needs of the investors on a regular and on-going basis. In brief, the portfolio management process involves.

- Identifying the investor’s objectives, preferences and constraints to develop an investment policy.

- Strategizing by determining the best combinations of financial and real assets available in the market and implementing the strategies.

- Studying the market conditions, relative asset values, and the client’s circumstances.

Doing the appropriate changes to the portfolio to reflect alterations in one or more pertinent variables.

Parties Involved in Portfolio Management

A portfolio manager is the person responsible for investing a fund’s assets, implementing its investment strategy and supervising the daily portfolio trading. Other parties involved in the process of portfolio management are.

- Marketers: People who bring the revenue for the company running the PMS by acquiring clients.

- Fund managers:The people who direct investment into the proper avenues.

- Compliance staff:Ones there to ensure accord with legislative and regulatory constraints.

- Internal auditors:Professionals to examine internal systems and controls.

- Financial controllers:Those for accounting for the institutions’ own money and costs.

- Computer experts and “back office” employees: They are there to track and record transactions and fund valuations for up to thousands of clients per institution.

Apply for Portfolio Manager Certification Now!!

http://www.vskills.in/certification/Certified-Portfolio-Manager