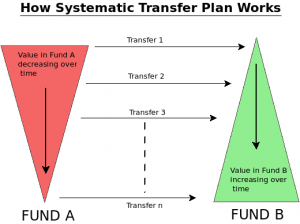

Systematic Transfer Plan

Imagine a scenario when you want to invest a big lump sum amount in stock market ? As markets are volatile and can go up or down very soon , there is always risk of loosing a big chunk of your investment (Learn about Stock Markets) . Take a case where you want to invest 10 lacs in Equity Mutual

funds and suddenly market crashes for next 2 months, In this case a big chunk of your investment will be lost, on the other hand if market moves up pretty fast, you can make a good profit. Here you have to decide your main focus. If it’s minimizing risk and getting good decent returns in long-term, You should use something called Systematic Transfer Plan (STP) .

Works as SIP : You can invest in a Debt funds and from there you can start a STP to an Equity Fund , so it works like a systematic Investment Plan (SIP) .

Works as SWP : So STP can also work like SWP, because with some funds you can do transfer from Equity funds to Debt Funds, so when markets look risky to you, you can start a STP from Equity -> Debt funds, which will act like SWP .

Liquidity : Generally one does STP from Debt -> Equity funds, so your money is invested in Debt fund. This means you can sell it anytime if you want. Hence it works like a Emergency Fund also. Incase you need money urgently, it can act like a liquid asset (at least for the time being in the start when you have more money in Debt fund)

Growth in Money : Not to forget that your money is invested in Debt funds, so your money is also growing at debt returns , at least the part which is lying in the debt funds .

Apply for Mutual Funds Analyst Certification Now!!

https://www.vskills.in/certification/mutual-funds-analyst