Setting Off & Carry Forward of Losses

Carry forward of losses is a tax provision that allows mutual fund investors to carry forward their losses from the previous financial year and offset them against gains made in subsequent years. In India, the Income Tax Act, 1961, permits the carry forward of losses for up to eight years from the year in which the loss was incurred. Mutual fund investors can claim this tax benefit by filing their income tax returns on time and disclosing their loss in the appropriate form. The carry forward of losses is an essential tool for investors to minimize their tax liabilities and maximize their returns.

There are two types of losses in mutual funds, namely short-term capital losses and long-term capital losses. Short-term capital losses arise when an investor sells mutual fund units within a year of their purchase. Long-term capital losses, on the other hand, occur when the mutual fund units are sold after holding them for more than a year. Investors can carry forward both short-term and long-term capital losses for up to eight years, provided they file their income tax returns on time and comply with the necessary tax regulations.

Investors must note that carry forward of losses is not an automatic process, and they must claim it in their income tax returns to avail of the benefit. Additionally, investors must maintain proper records of their losses, including the purchase and sale details of the mutual fund units, to avoid any discrepancies or errors in the filing process. The carry forward of losses is an essential tax-saving tool for mutual fund investors, and they must be aware of the necessary regulations and procedures to avail of this benefit.

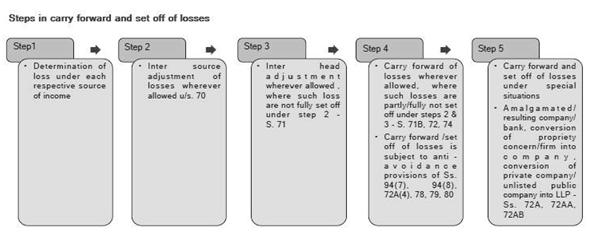

Income-tax is a composite tax on the total income of a person earned during a period of one previous year. It might happen that the net result from a particular mutual fund may be a loss. This loss can be set off against other sources/head in a particular manner.

Long term capital loss can be set off only against long-term capital gain. However, short-term capital loss can be set off from any capital gain (long-term or short-term).

Example:

Situation I Situation II

Short-term capital gain (-) 2, 00,000 (+) 5, 00,000

Long-term capital gain (+) 5, 20,000 (-) 1, 80,000

Solution:

In situation I, short-term capital loss of Rs. 2, 00,000 will have to be set off from long-term capital gain. Hence, the net long-term capital gain in this case shall be Rs. 3,20,000.

In situation II, it is not possible to set off long-term capital loss from short-term capital gain. Hence, short-term capital gain of Rs. 5,00,000 shall be taxable and Rs. 1,80,000 of long-term capital loss shall have to be carried forward.

In case of an Inter-head adjustment of losses, any capital loss, whether short-term or long-term, shall not be allowed to be set off against income under any other head. It shall however be allowed to be carried forward.

Any loss on short-term capital asset is allowed to be carried forward to be set-off in subsequent years against capital gains (short-term as well as long-term). The period of carry forward is 8 years. Any loss from long-term capital assets can also be carried forward to be set-off in subsequent years but against only long-term capital gains. The period of carry forward is 8 years.

Apply for Mutual Funds Analyst Certification Now!!

https://www.vskills.in/certification/mutual-funds-analyst