Disadvantages of Mutual Funds

A mutual fund is a type of professionally managed investment that allows a group of investors to pull their capital together and purchase securities, while sharing the burden of administrative and trading costs. There are many different types of mutual funds; open-ended funds sell an unlimited number of shares publicly, either in bulk or to retail investors (individuals), while close-ended funds limit their offering and once full, accept no more investors or capital. Other categories of differentiation are managed vs. passive, what industries or sectors they invest in (technology, industrial, financials, oil and gas, consumer services, consumer goods, healthcare, telecommunications, utilities, etc), the types of securities they purchase the size of the companies they target and the investment style.

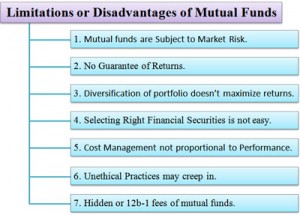

Disadvantages of Mutual Funds

Risks and Costs: Changing market conditions can create fluctuations in the value of a mutual fund investment. Also there are fees and expenses associated with investing in mutual funds that do not usually occur when purchasing individual securities directly.

No Guarantees: As Mutual funds invest in debt as well equities , there are no sure returns . Returns depends on the market conditions .

No Control: Investor does not have control on investment , all the decisions are taken by the fund manager. Investor can just join or leave the show.

Researching Mutual Funds

Unlike stocks, SEC regulations do not require mutual funds to give potential buyers specific facts like sales growth or P/E ratios. The mutual fund industry does not have to provide investors with information about their earnings per share and the specifics of how managers and research analysts recommend or choose stocks. This makes evaluating investment choices problematic since the net assets, which funds are required to provide, give a very incomplete picture of performance. Deciding who offers the best opportunity can be difficult, and using Morningstar or Lipper Ratings based on 1-month, 1-year, 3-year, 5-year, and 10-year returns will not indicate future performance.

Management, Trading and Operating Fees

Mutual funds typically have fees that are paid by shareholders purchasing or selling shares and annual operating fees that are between 1% and 3% of the assets under management. Operating fees are deducted from investor accounts. These fees reduce the amount of returns and if the fund has a bad year with low or no returns, part of the original investment can be lost, unless the fund decides to reduce or eliminate its management fees on a bad year to avoid withdrawals. While the cost of professional management is lower than the cost of an individual account, it is not free and investors should compare and review fees of different funds before deciding where to invest.

Apply for Mutual Funds Analyst Certification Now!!

https://www.vskills.in/certification/mutual-funds-analyst