Capital gains

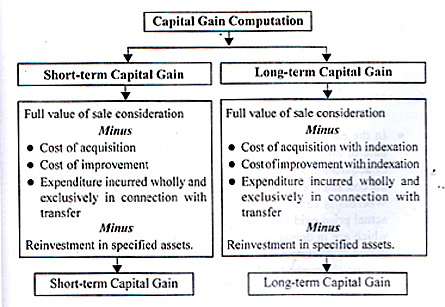

Mutual funds are investment vehicles that pool money from various investors and invest them in a diversified portfolio of stocks, bonds, and other securities. When investors sell their mutual fund units, they may make a profit or a loss. Capital gains occur when the selling price of the mutual fund units is higher than their purchase price. The difference between the selling price and the purchase price is the capital gain. Capital gains can be long-term or short-term, depending on the holding period of the mutual fund units.

In the case of mutual funds, capital gains are taxed differently depending on the holding period of the mutual fund units. If the holding period of the mutual fund units is less than 12 months, the capital gain is considered short-term capital gain, and it is taxed at a higher rate than the long-term capital gain. On the other hand, if the holding period of the mutual fund units is more than 12 months, the capital gain is considered long-term capital gain, and it is taxed at a lower rate.

Investors can reduce their tax liability on capital gains by choosing the right mutual fund schemes. Some mutual fund schemes are tax-efficient, which means they aim to generate higher returns with a lower tax liability. For instance, equity-linked savings schemes (ELSS) are tax-saving mutual fund schemes that offer tax benefits under Section 80C of the Income Tax Act. Moreover, dividend reinvestment plans (DRIPs) can also help investors save taxes as the dividend earned is reinvested in the mutual fund scheme and not paid out as cash.

As per SEBI Regulations, any scheme which has minimum 65% of its average weekly net assets invested in Indian equities, is an equity scheme. An investor in such a scheme will not have to pay any tax on the capital gains which he or she makes, provided that the scheme units are held for a 12-month period or more.

However, if the investor makes a profit by selling the units at a higher NAV (capital gains), within 12 months, then such a capital gain is treated as being short-term in nature, and hence taxed @ 15% of the profits.

Investors in all other schemes have to pay capital gains tax, either short term or long term. In case a scheme invests 100% in foreign equities, then such a scheme is not considered to be an equity scheme from taxation angle and the investor has to pay tax even on the long term capital gains made from such a scheme.

In case investors make capital gains within 12 months, for non-equity schemes, the capital gains are added to their income and then the total income is taxed as per their tax slab. This is known as taxation at the marginal rate.

For long-term capital gains made by investors in non-equity schemes, they have to pay tax either @ 10% or @ 20%, depending upon whether investors opt for indexation benefit or not.

Apply for Mutual Funds Analyst Certification Now!!

https://www.vskills.in/certification/mutual-funds-analyst