Cash and Credit Management

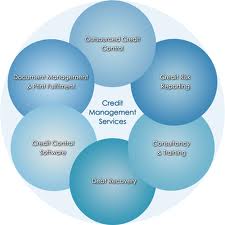

Credit management is an important function in every organization. Experts defined credit management as a balancing act between maximizing business revenue against minimizing credit loss.

All big and lucrative business deals involve some levels of credit risks. On the other hand companies cannot advance or function without credit. Therefore in order ensure a company enjoy the benefits of big and lucrative business deals and function properly, it has to management its credit well and efficiently.

Investing in receivables involves credit risk. It is impossible to eliminate credit loss totally. However it is possible keep credit loss to minimal through credit management. Practicing and executing efficient credit management will ensure the company makes good decision investing in good receivables with calculated credit loss.

Credit management is an act of balancing cost of investment in receivables against loss of profit earning opportunity.

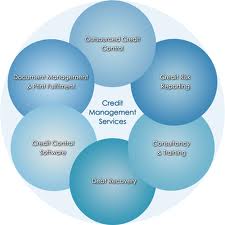

Investing in receivables involves credit risk. It is impossible to eliminate credit loss totally. However it is possible keep credit loss to minimal through credit management. Practicing and executing efficient credit management will ensure the company makes good decision investing in good receivables with calculated credit loss.

Credit management is an act of balancing cost of investment in receivables against loss of profit earning opportunity.

Investing in receivables involves credit risk. It is impossible to eliminate credit loss totally. However it is possible keep credit loss to minimal through credit management. Practicing and executing efficient credit management will ensure the company makes good decision investing in good receivables with calculated credit loss.

Credit management is an act of balancing cost of investment in receivables against loss of profit earning opportunity.