Let’s learn more about the Clearing and Settlement System. At the expiry of a commodity futures contract, the settlement is done financially (more common) or delivery of the goods is done. The settlement functions and formalities is headed by the ‘clearing house’. For example, National Commodity Clearing Limited (NCCL) is the clearing corporation for the NCDEX.

Clearing

Clearing of trades takes place through a clearing house which abides by strict compliance of all trade regulations and commitments undertaken on the exchange. Their main responsibility of tracking all the transactions of the day leads them to calculate the net position of each member. Going further, the clearing house is additionally accountable for

- Timely settlement.

- Trade registration and follow up.

- Monitoring open interest.

- Financial clearing of all payments

- Fulfilling the physical settlement (delivery) or financial settlement (price difference) of contracts.

- Management of financial guarantees demanded by the participants.

The work at clearing houses is delegated to a number of members who perform a function in the process of clearing and settling of the commodities traded.

Similar to broker margin accounts, the clearing house members are also supposed to maintain proper levels of margins according to the profits and losses of each day. Depending on the margin balance in their account, funds are either added to the existing amount or it needs to me replenished.

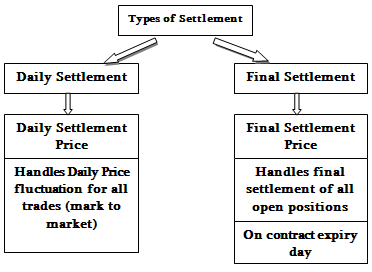

Futures contracts have two types of settlements: (i) the Mark-to-Market (MTM) settlement which happens on a continuous basis at the end of each day, and (ii) the final settlement which happens on the last trading day of the futures contract. On the exchanges like the NCDEX, daily MTM settlement and final MTM settlement for futures contracts are cash settled by debiting/crediting the clearing accounts of CMs with the respective clearing bank.

Settlement Price

All positions of a CM, either brought forward, created during the day or closed out during the day, are marked to market at the daily settlement price or the final settlement price at the close of trading hours on a day.

- Daily settlement price: This is the agreed closing price of futures contract that is arrived at after the closing of the market session. In some cases when trading has not been done for a contract during closing session, daily settlement price is ascertained as per the methods prescribed by the exchange from time to time.

- Final settlement price: This is the polled spot price of a commodity on the last trading day of the futures contract. In futures, the open positions cease after its expiration day and a Professional Clearing Member settles all the participants’ trades which have been confirmed to the Exchange.

Settlement involves payments (Pay-Ins) and receipts (Pay-Outs) for all the transactions done by the members. Trades are settled through the Exchange’s settlement system.