The Certified Options Trader certification molds the candidates as per the firms’ requirements in different areas. This certification demonstrates your capability in performing and functioning tasks in areas like Understanding Options, Options Trading, Price Index, Pricing Of Options, Market Information, Strategic derivative tools, volatility Delta, options trading strategies, long combo, long straddle, derivatives risk, accounting and taxation of options trading.

Roles and Responsibilities of an Options Trader

The roles and responsibilities of a Certified Option traders are mentioned below

- Firstly, to manage risk in the market and to develop derivatives strategies.

- Secondly, to develop a strategy and collaborate with software developers, traders, and analysts.

- Then, to manage the risks of an active, electronic and automated trades platform and also carry’s the capability understanding portfolio level hedging of Greeks

- Also, to know how to deploy index, currency, and single stock option market and to create trading strategies.

- Finally, to analyze trading performing and develop trading work closely with programmers

Why become a Certified Options Trader?

Highly skilled Options Traders professionals are in huge demand. Candidates looking for a better career opportunity must take this certification to enhance their skills and confidence. In addition, both public and private sectors also require Options Trader professionals for their trader departments. Moreover, Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and Shine.com.

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1136

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Career as an Options Trader

A job as an options trader may be a suitable fit for people who have a knack for mathematics and are interested in the stock market. An options trader invests in options, which are contracts that provide a stock owner the right to purchase or sell a stock at a certain price for a set period of time. Let us know about Career as an Options Trader!

Certified Options Trader Course Outline

Certify and Increase Opportunity.

Be

Govt. Certified Options Trader Professional

1. Introduction

1.1 Indian Derivatives Market: An Overview

1.2 What are Derivatives?

1.3 Evolution of Derivatives Market

1.4 Types of Derivatives

2. Understanding Options

2.1 Options: An Overview

2.2 Types of Options

2.3 Advantages of Options

2.4 Trading System

2.5 Procedure for Margin Collection

2.6 Types of Orders

2.7 Settlement Schedule for Option Contracts

2.8 Settlement Mechanism

2.9 Writing of Options

3. Option Trading

3.1 Market-wide Limits

4. Price Index

4.1 What is Index?

4.2 Eligibility Criteria of Indices

4.3 Construction of Index

4.4 Desirable Attributes of an Index

5. Pricing Of Options

5.1 Black-Scholes Option Pricing Model

5.2 Pricing of Equity Options

5.3 Pricing of Options on Dividend Paying Scripts

5.4 Binomial Model of Option Pricing

5.5 Pricing of Binomial Put Option

5.6 Binomial Multiple Period Model

6. Strategic Derivative Tools

6.1 Put-call Parity

6.2 PC Ratio

6.3 Weighted PC Ratio

6.4 Volume PC Ratio

6.5 Tools to Measure Market Sentiment

7. Volatility

7.1 Types of Volatility

7.2 Estimating Volatility

7.3 Estimating Historical Volatility

7.4 Factors Affecting the Computation of Historical Volatility

7.5 Implied Volatility

7.6 Volatility Smile

7.7 GARCH

7.8 Impacts of Implied Volatility and Underlying Asset Price on Purchase of Options

7.9 Volatility Trading

7.10 NSE Volatility Index

7.11 Behavioral Study of Nifty Options Distress

7.12 Impacts of Events on Volatility-A Case Study

7.13 Comparative Study of the Behavior of Nifty and IT Stocks During an Event

7.14 Impact of Quarterly on Stock Futures

7.15 Volatility Skew

7.16 Stochastic Volatility

7.17 Volatility Arbitrage

7.18 Volatility Change

8. Option Greeks

8.1 Delta

8.2 Gamma

8.3 Vega

8.4 Theta

8.5 Rho

9. Option Trading Strategies

9.1 Advantages of Strategies

9.2 Buying Put Option

9.3 Bear Spread with Puts

9.4 Long Put Ratio Spread

9.5 Bear Spread with Call

9.6 Synthetic Short

9.7 Short Put Ladder

9.8 Long Combo

9.9 Long Call Christmas Trees

9.10 Short Put Albatross

9.11 Short Straddle versus Put

9.12 Short Strip with Calls

9.13 Long Guts

9.14 Long Call Ladder

9.15 Long Iron Butterfly

9.16 Long Put Spread versus Short Call

9.17 Basic Option Strategies

9.18 Trading Strategy Adopted by Nick Leeson

9.19 Short Straddle

9.20 Long Straddle

9.21 Covered Call Writing

9.22 Probability

9.23 Spread Trading

9.24 Contango and Backwardation

9.25 Trading Strategies with Long -Term Options

9.26 Portfolio Hedging by Call Writing Portfolio Hedging Through Delta Hedge

9.27 Diagonal Spread

10. Market Information

10.1 Introduction

11. Risk In Derivatives

11.1 Risk in Options

11.2 Is Writing Options a High Risky Strategy?

11.3 Classification of Risks

11.4 Elimination of Market Risk through Hedging

12. Accounting And Taxation Of Option Trading

12.1 Accounting Norms for Equity and Index Options

12.2 Charges in F&O Segment

12.3 Taxation of Derivatives

12.4 Income Tax

Preparation Guide for Certified Options Trader Exam

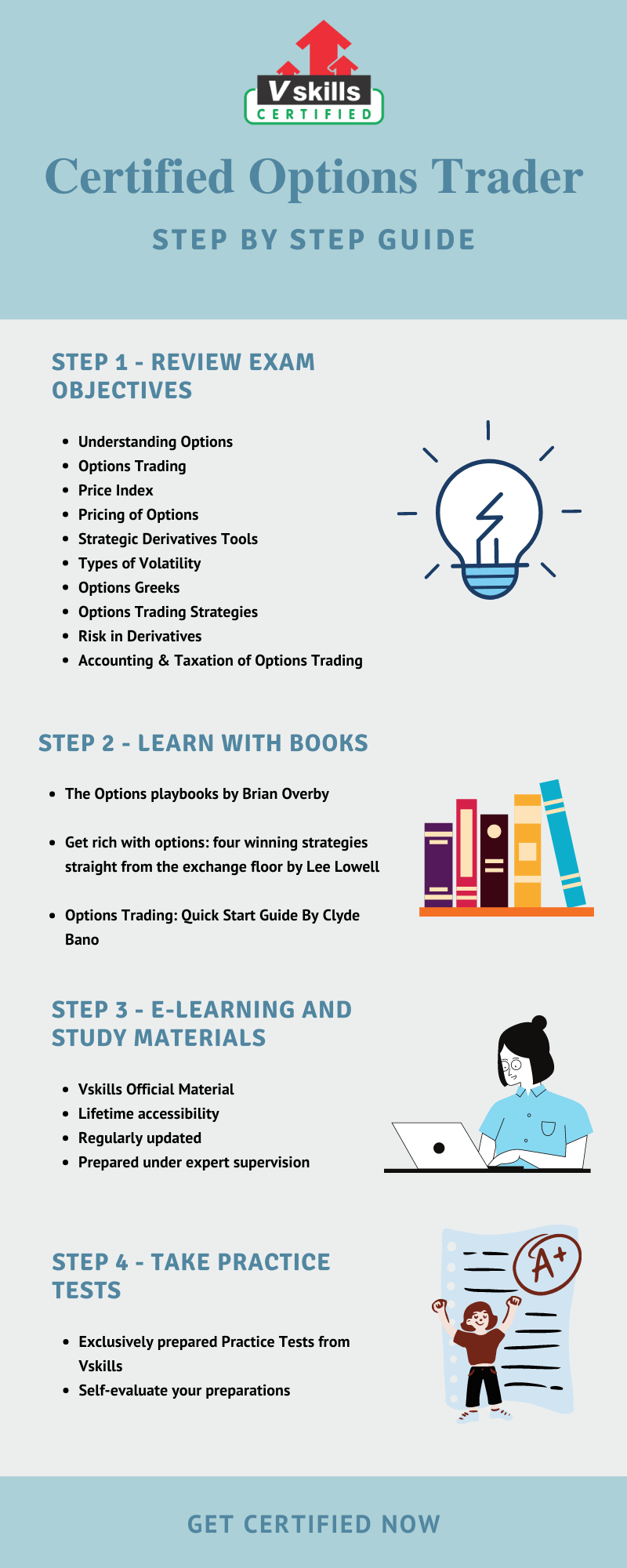

To crack any exam proper implementation of steps is necessary, but what are those steps? This preparation guide escorts you to all the essential steps involved in the journey of exam preparation. Preparing yourself with the correct resources and process is the key to come out with flying colors in the exam. This study guide is a map to your success in achieving your desired certification.

Step 1 – Review Exam Objectives

The first and foremost thing before you start preparing is to get well versed with the objectives of the exam. This will let you understand the way through which you will prepare for the exam and then help attain your certification. Below-mentioned are the objectives of the Certified Options Trader Exam –

- Firstly, Understanding Options

- Secondly, Options Trading

- Thirdly, Price Index

- Pricing of Options

- Also, Strategic Derivatives Tools

- Then, Types of Volatility

- Options Greeks

- Subsequently, Options Trading Strategies

- Risk in Derivatives

- Finally, Accounting & Taxation of Options Trading

Refer: Certified Options Trader Brochure

Step 2 – Learning the Traditional Way through Books

Books are the finest sources for gaining knowledge. Studying the concepts from books help to build and memorize the proper foundation of the topic. Although books are old school methods of studying but have proven to be the most effective one. The books mentioned below are the top 3 books preferred for the Certified Options Trader exam.

- The Options playbooks by Brian Overby – The book simplifies the option trading concepts and guides the investors for trading under different concepts like strategies, break-even at expiration and the sweet spot for trade execution and many more are mentioned with fine details

- Get rich with options: four winning strategies straight from the exchange floor by Lee Lowell – The book is considered one of the most reliable books. It is filled with deep insights and expert guidance and knowledge needed for but results with the options market.

- Options Trading: Quick Start Guide By Clyde Bano – The book consists of rich information about options, trading fundamentals with concern to call and put options, sound option strategy, and many more. The book especially is beneficial for newcomers, who are new to options.

Step 3 – E-learning and Study material

E-learning is one of the most effective learning methods today. It helps us to understand concepts well by the visual way of teaching. As it has most of the content available, it adds knowledge with a clearer perspective. Moreover, the online availability of the exam matter helps a person understand the topics in an easy way. Vskills offers you its E-Learning Study Material and its hard copy as well, to supplement your learning experience and exam preparation. Moreover, this online learning material is available for a lifetime and is updated regularly.

Step 4 – Check your Progress with Practice Tests

Putting efforts into the Practice tests allows the candidate to explore more with the examination format. The practice test helps to analyze our potential mistakes, and with that, there is a chance to correct those mistakes. Moreover, along with making us familiar with the different types of questions that might be asked, it also helps us gain the confidence to appear in the final exam. So build up your confidence with free practice tests Now

Job Interview Questions

Prepare for your next job interview with our latest expert created online interview questions, the questions are designed to enhance your skills and make you job ready.