A certified Corporate Finance Analyst is a practitioner who basically analyses historical data and makes projections, types of financial analysis ratio, and company performance and keeps the record on excel using a spreadsheet. The Vskills Certified Corporate Finance Analyst certification evaluates candidates as per the company’s requirements for the finance department. It will assess you on areas like financial statement analysis, bonds and stock valuations, NPV, risk statistics, capital asset pricing model, capital budgeting, long term financing, capital budgeting, dividends, issuing securities, and long term debts.

Why become a Certified Corporate Finance Analyst?

The Corporate Finance Analyst course is primarily designed for the professionals and graduates who aspire to shine in their respective fields, and would like to attempt this certification for their further progress in the finance department. Vskills Corporate Finance Analyst certification will help you stand out from the crowd in this competitive world and increase your employment opportunities and help you earn potential as well.

Who should take this certification?

Candidates who wish to improve their skills and want to make their CV’s stronger, especially newly graduate students, must take the Corporate Finance Analyst certification. This certification will help you get the best job opportunity in the organisation.

Roles and Responsibilities of a Certified Corporate Finance Analyst

Knowing what are the tasks that we have to undertake after completing the certification prepares us for the future, therefore always get a glimpse of the responsibilities you have to undertake. The following are the duties of a Certified Corporate Finance Analyst.

- To report and operate metrics tracking and also perform financial forecasting

- To develop financial decision models for decision making and keep track of financial performance

- To analyze previous results, perform variance analysis, recognize trends, and recommend ideas for improvement

- To create and enforce policies and procedures and guide the cost analysis accordingly

- To recognize trends and recommend ideas for optimization based on the analysis of the trends

- To increase productivity and smooth function by developing automated reporting/ forecasting tools.

- To perform and maintain market research, data mining, business intelligence, and valuation comps.

- To develop a strong financial analysis base developing forecasts and models.

Career in Corporate Finance

If you want to get paid the most as a corporate finance analyst, being employed by a company such as Google or Yahoo would be a smart choice, as they are the highest paying companies in this field. Let us get into details of corporate finance career opportunities.

Benefits of taking Vskills Certification

Vskills being India’s largest certification provider gives candidates access to top exams as well as provides after exam benefits. This includes:

- The certifications will have a Government verification tag.

- The Certification is valid for life.

- Candidates will get lifelong e-learning access.

- Access to free Practice Tests.

- Candidates will get tagged as ‘Vskills Certified’ On Monsterindia.com and On Shine.com.

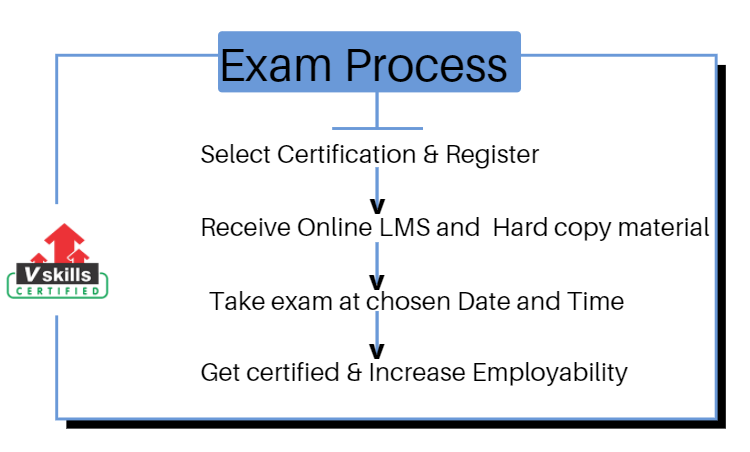

Exam Details

- Exam Duration: 60 minutes

- Vskills Exam Code: VS-1130

- Number of questions: 50

- Maximum marks: 50

- Passing marks: 25 (50%)

- Exam Mode: Online

- There is NO negative marking in this module.

Course Details

Certify and Increase Opportunity.

Be

Govt. Certified Corporate Finance Analyst

Generational forms of Business

- Forms of Business Organization

- Proprietary Concerns

- Joint Stock Companies

- Co- Operative Organizations

- Public Enterprises

- Comparison among Different Forms of Organisations

- Market Value and Stock Prices versus Book Value

Organization Chart & Finance Function

- Fictional Organization

- Product / Market Organization

- Line and Staff functions/Relationship/ Authority

- Functional and Line Authority

- The Concept of Finance

Finance Function-Organization, Objectives & Decisions

- Corporate Finance

- Corporate Finance & Other Functions

- Organization of the Finance Function

- Objectives Financial Management

- Profit Maximization

- Wealth Maximization

- Other Finance Functions

Financial Statements, Analysis and Information

- Balance Sheet

- Profit and Loss Account

- Financial Statements-Analysis & Interpretation

- Comparatives Financial Statements

- Common Size Statements

- Projected Balance Sheet

- Statement of Changes in Financial Position(SCPP)

- Funds Form Business Operations

- Statement of Changes in Total Resources

Cash Flow Statement

- Type of Cash Flow

- Actual Flow of Cash:

- Notional Cash Flow

- Notional outflow of cash

- Source of Cash Inflow

- Net Profit Method

- Outflow of Cash

- Changes in Current Accounts

- Change in Current Liabilities

Corporate Income Tax

- Personal Taxation and its Influence on Firm

- Deductibility of Expense

- Set-Off and Carry forward of Losses

Time Value of Money

- Simple interest

- Future Value at Simple Interest

- Present Value

- Compound Interest

- For Series of Payments

- Future or Compound Value

- Present (or Discounted) Value

- Multi-period or Semi-annual and other compounding

- Net Present Value

- Internal Rate of Return

- Mathematical Derivation of Formula for Future/Compound Value of Annuity

The Financial Securities

- Equity Shares

- Features of Equity Shares

- Advantage of Equity shares

- Disadvantages of Equity Share

- Preference share

- Feature of Preference share

- Types of Preference Shares

- Advantage or Merits of Preference Share

- Disadvantages of Preference shares

- Debt Securities-Debentures or Bonds

- Features of Debentures or Bonds

- Types of Debentures

- Advantage of Debentures

- Disadvantages of Debentures

- Treasury Bills (T-Bills)

The Financial Markets

- Functions of Financial Markets

- Classification of Financial Markets

- Methods of Floatation

- Indian Capital Market Participants

- Scenario of Indian Capital Market

- Transaction cost in Capital Market

International Financial Markets

- International Financial System and Foreign Exchange Market

- Market Features of International Markets

- Euro Currency Market

- Functions of Eurocurrency Market

- Eurobond Market

- Brief Procedure in Eurobonds Issues

Financial Institutions

- Activities of UTI includes

- UTI Schemes

- Industrial Development Bank of India(IDBI)

- Major Schemes of IDBI

- Industrial Credit and Investment Corporation of India (ICICI)

- Industrial Finance Corporation of India (IFCI)

- Industrial Reconstruction Bank of India (IRBI)

- Industrial Investment Bank of India (IIBI)

- Insurance Companies

- General Insurance Corporation (GIC)

- Stock Holding Corporation of Indian Ltd.(SHCIL)

- Ratings

- Rating Factors

- Credit Rating and Information Services of India Ltd (CRISIL)

- Information and Credit Rating Agency (ICRA)

- Duff and Phelps

Interest Rates

- Role of Interest Rates

- Interest Rates and Share Prices

- Factors Influencing Interest Rates

- Rates in Gilt –edged Market

- Private and Government Bond Rates

- Rates of Borrowings and Leading by Commercial Bank

- Interest Rates on Small saving

- Export Credit

Basic Valuation Model

- Bond Valuation

- Valuation of Preference Shares

- Stock Valuation

- Single Period Valuation Model

- Multi-period Valuation Model

- Zero Growth Model

- Constant Growth Model

- Stock Valuation: The P/E Ratio Approach

- Market Efficiency

Risk

- Systematic or Non Diversifiable Risk

- Unsystematic or Diversifiable Risk

- Measures of Risk

- Rate of Return

- Probability Distribution

- Continuous Probability Distributions

- Standard Deviation of Return

- Risk Return Relationship

- Diversification and Risk

- Measurement of Portfolio Risk

- Beta

- Security Market Line

Investment Decision Rules

- Category of Investment Decision Rules

- Accounting Income-based Decision Rule

- Return on Capital

- Return on Equity

- Cash Flow-based Decision Rule

- Decision rule

Cash FLow

- Cash Flow

- Definition

- Need for Cash Flow Statement

- Discount Rates

- Estimation of Cash Flow

- Depreciation & Taxes

- Components of Cash Flow

- Initial investment

- Annual Net Cash Flows

- Terminal Cash Flows

Incremental Analysis

Break-Even Analysis

- Variable Costs

- Fixed cost

- Semi-variable Cost

- Contribution Margin

- Strategies for Break-even Point

- Utility of the Break-even Analysis

- Shortcomings of the Break-even Analysis

Project Proposals

Investment Decisions

- What are Capital Investment Decisions?

- Why is Capital Investment Decisions Important ?

- Growth

- Risk

- Types of Capital Investment Decisions

- Expansion and Diversification

- Replacement and Modernization

- Capital Investment Evaluation Criteria

Capital Budgeting Techniques

- Capital Budgeting

- Net present Value (NPV) Method

- Internal Rate of Return Method

- Profitability Index or Benefit-cost Ratio

- Payback Method

- Discounted Payback Period

- Accounting Rate of Return Method

Financial Structure – Capital

- Financing Decision

- Financial Structure

- Types of Capital

- Factor Affecting Financial Structure

- Agency Costs

Financial Distress – Remedial Options

Corporate Restructuring Options

- Divestitures

- IPO Roll-Ups

- Going-Private Transactions

- Alternatives to the Corporate Form

- The Market for Corporate Control

- Synergistic Mergers

- Strategic Mergers and Acquisitions

- The Twenty-First Century

- Successful Merger

- Upon Completion

Cost of Debt

- Concept of the Cost Capital

- Cost of Debt

- Debt Issued at Per

- Debt Issued at Discount or Premium

- Cost of Term Loans

Cost of Capital

- Cost of Preference Capital

- Irredeemable Preference Share

- Redeemable preference shares

- Cost of Equity Capital

- Is Equity Capital Free of Cost

- Cost of Retained Earnings

- Zero-growth

- Cost of External Equity

- Realized Yield Approach

- Capital Assets Pricing Model Approach

- Bond Yield plus Premium Approach

- Weighted Average Cost of Capital

- Weight Marginal Cost of Capital

- Book-Value Vs, Market-Value Weights

Financial Leverage

- Leverage

- Measure of Leverage

- Application and Utility of the Financial Leverage

- Impact of Financial Leverage on Investor’s Rate of Return

- Financial Leverage and Risk

- EBIT-EPS Analysis

Dividend Policy

- Dividend Policy

- Dividend Decision

- Shareholders’ Expectations

- Financial Needs of the Company

- Constraints on Paying Dividends

- Stability of Dividends

- Constant Payout

- Danger of Stability of Dividends

Forms of Dividend

Dividend Model & Its Decisions

- Dividend Decision

- Traditional Position

- Walter Model

- Gordon’s Dividend Capitalization Model

- Miller & Modigliani Position

- Rational Expectations Model

Financial Ratios

- Meaning of Ratio

- Types / Classification of Ratios

- Liquidity Ratios

- Activity Efficiency or Turnover Ratio

- Profitability in relation to Sales

Working Capital Management

- Components of Working Capital

- Constituents of Current Liabilities

- Significance of Working Capital

- The Cash Conversion Cycle

- Working Capital Policy

- Current Asset Policy

- Sources for Financing Working Capital

- Shares and Debentures

- Ploughing Back of Profits

- Loans from Financial Institutions

- Sources of Short term Working Capital

- Installment Credit

- Factoring or Accounts Receivable Credit

- Accrued Expenses

- Deferred Incomes

- Commercial Paper

Bank Credit

- Loans

- Cash credit

- Overdraft

- Purchasing and Discounting of Bills

- Principles of Bank Financing

- Tandon Committee Report

- Maximum Permissible Bank Finance (MPBF)

- Chore Committee Report

- Credit Authorization Scheme

Preparation Guide for Certified Corporate Finance Analyst Exam

We always need a guide who can show us the right path to reach our destination but, it is also important to choose the right guide in that process. A good preparation guide should consist of all the essential resources for the preparation of a certification exam so that an individual doesn’t face difficulty at the last moment. The preparation guide below will guide you with the right directions.

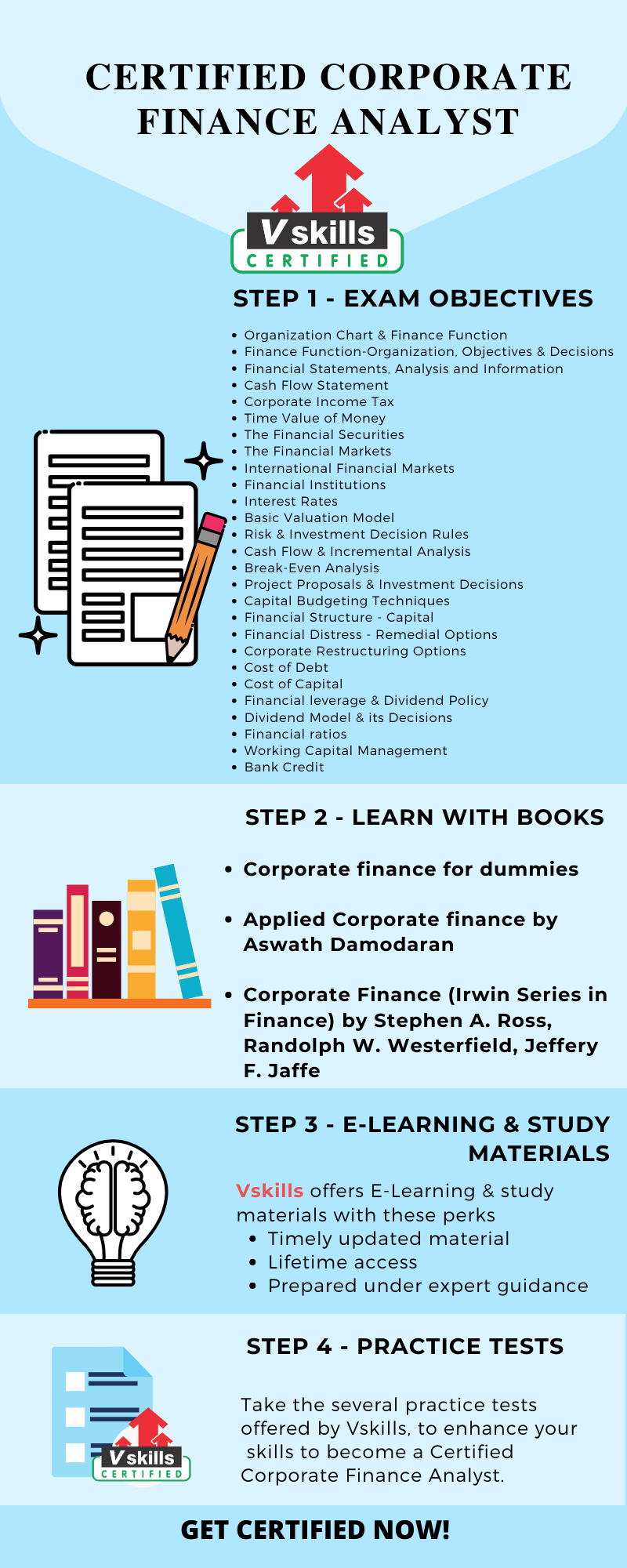

Step 1 – Review the Exam Objectives

There is always a curiosity of knowing what we are going to learn during any course, as it is necessary also because it keeps us motivated and attentive. The following are the exam topics that we will cover in this certification exam.

- Organization Chart & Finance Function

- Finance Function-Organization, Objectives & Decisions

- Financial Statements, Analysis and Information

- Cash Flow Statement

- Corporate Income Tax

- Time Value of Money

- The Financial Securities

- The Financial Markets

- International Financial Markets

- Financial Institutions

- Interest Rates

- Basic Valuation Model

- Risk & Investment Decision Rules

- Cash Flow & Incremental Analysis

- Break-Even Analysis

- Project Proposals & Investment Decisions

- Capital Budgeting Techniques

- Financial Structure – Capital

- Financial Distress – Remedial Options

- Corporate Restructuring Options

- Cost of Debt

- Cost of Capital

- Financial leverage & Dividend Policy

- Dividend Model & its Decisions

- Financial ratios

- Working Capital Management

- Bank Credit

Refer: Certified Corporate Finance Analyst Brochure

Step 2 – Learning with Books

Books have been the most sincere method of studying. All around the globe, books still have the same value like they had before the technology came into existence. It gives you all the knowledge that you should know about that particular domain, covering all the topics and sub topics in detail. The mention below are the top 3 books for this certification exam.

- Corporate finance for dummies. This book is considered one of the best introductory books for finance students. It will give detailed knowledge regarding the corporate methods and theoretical concepts on the pragmatic application of principles. The book focuses on critical areas like mergers and acquisitions.

- Applied Corporate finance by Aswath Damodaran. This book displays the context of six real-world companies and clears the decision making concepts for the firm. It will give you a pragmatic approach towards the concept of the finance department and will motivate you to do better.

- Corporate Finance (Irwin Series in Finance) by Stephen A. Ross, Randolph W. Westerfield, Jeffery F. Jaffe. This book consists of the most challenging aspects of the study of corporate finance, including integrating all the complex aspects into a coherent whole. It will give illustrations on the real-world examples and case studies

Step 3 – E-Learning and Study Materials

E-learning is a very efficient source of delivering courses online. The online resources are available anytime and anywhere, which are easily accessible. Web-based learning makes the learning process fun and helps to grab knowledge in a short time. There are various ways of learning online, you can choose yours and learn accordingly. This will improve your knowledge in your particular domain. Study materials are the modern type of notes, which are ready for you to study.

Vskills offers E-Learning Study Material for the Certified Corporate Finance Analyst exam. One very special advantage of Vskills learning material is its timely updates and lifetime access. In addition to supporting your e-learning, Vskills also provides study materials in hard copy for the candidates preferring offline study methods.

Refer: Certified Corporate Finance Analyst Sample Chapter

Step 4 – Check your Progress with Practice Tests

How do you know you are prepared for the examination? The best answer can be only given after you self-evaluate yourself through practice tests. Practice tests help you improve your weaker sections and correct them in time. Multiple practice test keeps you updated about your progress, hence always attempt practice test before examination.

Strengthen your concepts and make your resume stand out with the Corporate Finance Analyst certification. Start Practicing Now

Prepare for Job Interview

Are you preparing for finance? then you must checkout these corporate finance interview questions, these questions will enhance your knowledge and helps you to clear the interview. Checkout now !