Heads of Income Tax

The Heads of income tax is divided into five parts:

- Salary

- Income from house property

- Profits and gains of business or profession

- Capital Gains

- Income from other sources

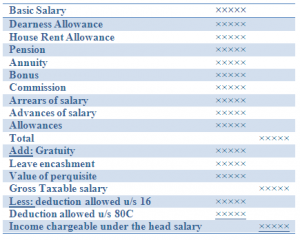

Income from Salary

As per the income tax law in India, any income that is generated under the territory of the country is subjected to the income tax. Salary is taxed differently than the products as income tax is applicable on salary whereas on commodities service tax and value-added tax is applicable. The term salary is defined as any kind of remuneration that is generated through professional services and from different jobs in the organization.

Income from house property

Income from House property is calculated by considering the Annual Value. The annual values (for a let out property ) is based on the following:

- HRA Rent Received

- Municipal Valuation

- Fair Rent (as determined by the IT department)

However if a house is not let out and not self-occupied, then the annual value is assumed to have accrued to the owner. In case of a self-occupied house, annual value is to be taken as NIL. Nut there is more than one self occupied house then the annual value of the other house/s is taxable. From this, Municipal Tax is deducted to arrive at the Net Annual Value.

Income from Business or Profession

Income from business, profession or vocation is taxed under this head. It includes the following:

- Profits or gains of a business

- Any compensation or such payment due/received by any person in connection with modification/termination of his management; etc.

- Income derived by a trade, professional association from specific services for its members;

- Export incentives;

- Value of any benefit arising during carrying out of business;

- Any interest, salary, bonus, commission or remuneration due / received by a partner from the firm in which he is partner

- Any sum received under Keyman insurance Policy

- Income from speculation business, etc.

How is income from Business or Profession computed?

Income chargeable to tax is computed after deducting the following:-

- Expenditure incurred during the previous year wholly and exclusively for the purpose of the business;

- After deducting allowances and deductions provided in Sections 30 to 43D of the I.T. Act. 1961;

- The following expenses are not allowable:-

- Expenditure relating to a discontinued business;

- Expenditure incurred before setting up of a business;

- Provisions, anticipated losses, reserves or contingent liabilities, bad debts etc. which have not arisen during the previous year

Income from Capital Gains

Under the Income Tax Act, any profits or gains arising from the transfer of a capital asset effected in the previous year, shall be chargeable to income tax under the head ‘capital gains’ and shall deemed to be the income of the previous year in which the transfer took place unless such capital gain is exempted under the prescribed exemptions.

‘Capital gains’ means any profit or gains arising from transfer of a capital asset. If any Capital Asset is sold or transferred, the profits arising out of such sale are taxable as capital gains in the year in which the transfer takes place. Capital gains is the difference between the price at which the capital asset was acquired and the price at which the same asset was sold. In technical terms, capital gain is the difference between the cost of acquisition and the fair market value on the date of sale or transfer of asset.

Under the existing provisions of Section 2(14), a ‘capital asset’ means, property of any kind held for personal use by the assessee, whether or not connected with his business or profession, personal effects held for personal use by the assessee or any number of his family dependent on him are excluded from the ambit of the definition of capital asset. The only asset that is in the nature of personal effects, but is included in the definition of capital asset is jewellery and ornaments. However, with effect from assessment year 2008-09, archeological collections, drawings, paintings, sculptures or any work of art have also been excluded from the meaning of personal effects and transfer of such personal effects will also attract capital gains tax. Capital Assets are of two types i.e., long term and short term. A capital asset held for 36 months or less before it is sold or transferred is called as a short-term capital asset and if the period exceeds 36 months, the asset is known as a long-term capital asset. In case of shares, debentures and mutual fund units the period of holding required is only 12 months. Transfer of a short term capital asset gives rise to “Short Term Capital Gains” (STCG) and transfer of a long capital asset gives rise to “Long Term Capital Gains” (LTCG). Different rates of tax apply for gains on transfer of the long term and short-term capital assets. Gains on short-term capital asset are taxed as regular income

Income from other Sources

Sections 56 to 59 deal with the provisions for computation of income under the head ‘income from other sources’. This is a residuary head covering all incomes which do not specifically fall under any of the heads mentioned earlier. Some of the types of income which are assessable under this head are mentioned below:

- Dividends or income from units of mutual fund.

- Interest including ‘interest on securities’ if it is not taxable under the head ‘Profits and gains of business or profession’.

- Income such as:

- Ground rent or rent received or sub-letting a property.

- Winning from lotteries, cross-word puzzles, races including horse races, card games or from gambling or betting etc.

- Income from hiring of machinery, plant or furniture unless such a hiring is the business of the taxpayer.

- Family pension.

In computing the taxable income under this head, deduction is allowable for expenditure (other than capital expenditure) which is incurred by the tax payer wholly and exclusively for the purpose of earning such income. Besides, in assessing dividend income, any remuneration or commission paid for realizing such income is allowed as deduction. In assessing income from letting the machinery, plant or furniture on hire, the depreciation on the value of such assets calculated in the same manner as in respect of assets used in a business or profession is allowable as a deduction. No deduction is, however, allowed in respect of-

- Any personal expenditure of the tax payer;

- Any salaries or interest payable outside India from which tax is deductible at source under the Act but has not been deducted.